Top 10 Prospect Research Techniques Every B2B SDR Must Employ in 2025

- Last updated on: July 14, 2025

Implementing prospect research techniques in today’s B2B lead generation is a game-changing approach.

B2B prospecting in 2025 needs more than a shot in the dark. It is a well-thought-off procedure.

In this article, we will discuss the top 10 tested prospect research strategies for sales development representatives (SDRs) to customize outreach, prioritize accounts, and engage with high-intent buyers.

Intelligent Prospecting Begins with Improved Research

You’re probably an SDR, and you’re swimming through a sea of outreach with decreasing response rates. The face of the B2B buyer has changed. Today’s buyers are smarter, more savvy, and bombarded with cliché sales messages that don’t quite strike a chord.

It’s not the amount of activity that makes a successful outreach anymore, but the research quality driving each interaction. By 2025, great prospecting isn’t about intuition or luck; it’s about precision, timing, and relevance.

The top players in the market use the following tested, research-based strategies utilized by top-performing SDRs to connect with high-intent buyers and drive substantial pipeline influence.

The Top 10 Research Techniques that Help SDRs Engage the Right Buyers

1. Company Profiling with Firmographics & Technographics

In order to develop a good message, you need to know about the company behind the contact. Firmographics give you a place to start: industry, size, revenue, and location. Technographics bring a rich layer of insight, though, those tools, platforms, and systems that the business already depends upon.

Discover company growth indicators like new hiring trends, funding rounds, or geographic expansion.

Notice what CRM, CMS, ERP, or customer support software is currently utilized.

Notice compatibility or integration potential with your product to make it more relevant.

This two-layered strategy allows SDRs to get past vanilla messaging.

For instance, if a company just raised $20M and is hiring RevOps professionals, it’s a very good indicator they’re growing operations and perhaps assessing their existing tech stack.

According to a 2025 report by Martal Group, over 70% of companies now incorporate firmographic, technographic, and behavioral data into their ABM or SDR workflows as a best practice.

2. Timing Outreach with Trigger Events & Industry News

Outreach is not so much about who, but when. Timing can make all the difference between being relevant and being invisible. Trigger events like funding news, acquisitions, executive moves, layoffs, or new product releases usually indicate strategic change within an organization. And strategic change opens up windows of opportunity for solution providers.

To remain ahead of the game, set up Google Alerts for major accounts, track Crunchbase for funding news, and check company pages on LinkedIn for leadership announcements or press releases. These are alerts that will inform prioritization based on recent momentum.

For instance, if a company just added a new VP of Sales, that’s your trigger. New executives tend to bring new tools, re-evaluate vendor relationships, and seek early wins.

LinkedIn Sales Insights data shows SDRs who customize their outreach with recent company news experience a 39% increase in response rates, evidence that context indeed converts.

3. Intent Data Buyers’ Prioritization

Why chase cold leads when you can go after companies already indicating interest in your category?

Intent data platforms like Intent Amplify enable you to detect companies in the process of researching solutions like yours. These platforms monitor content consumption behaviors on thousands of sites and platforms and mark which institutions are exhibiting higher interest in relevant subjects, competitors, or keywords.

This level of exposure allows SDRs to concentrate their resources and time on those accounts that are more likely to convert, instead of burning cycles on unqualified leads. Using advanced filtering, you can even rank intent signals by personas or jobs.

Suppose a target account is engaging with content on “AI-driven marketing automation,” and your platform supports that feature, then your outreach can be contextual and timely.

Gartner finds that companies that use intent data in outbound prospecting see a 30–35% increase in win rates. It’s no longer a nice-to-have, it’s a critical part of predictable pipeline creation.

4. Competitor Stack & Market Position Analysis

Knowing what tools your prospect’s competitors utilize can provide you with a distinct competitive advantage. It enables you to position your solution not only as beneficial but as essential to remain relevant.

Suppose your prospect’s main competitor just transitioned to a highly ranked automation platform. That provides you with the context to develop messaging focused on innovation, market position, and being left behind.

Leverage tools such as G2, TrustRadius, and customer success stories to:

- See what technologies comparable companies are embracing

- See where there are pain points in your prospect’s existing workflow or stack

- Position your solution as a strategic act, rather than a tactical solution

You can also use public wins, such as competitor press releases or award notifications, to back up urgency in your outreach.

McKinsey’s 2024 study indicates that 84% of B2B purchasers review at least three vendors before they schedule a demo. When you make your prospect see where they are—and what’s achievable, they’re more likely to put you on that shortlist.

5. Job Titles & Decision-Making Authority Explained

Job titles don’t always speak for themselves. The same “IT Director” at firm X is perhaps in charge of infrastructure; at firm Y, they might be responsible for cybersecurity budgets, vendor assessments, or even compliance programs.

That’s why it is essential to move beyond job titles. Review LinkedIn job descriptions to get a sense of real responsibilities. Review team structures, past roles, reporting lines, and functional overlaps. See how responsibilities are getting allocated and who will be most likely to influence or approve purchases.

Having an understanding of the difference between decision-makers, influencers, and gatekeepers can make or break an outreach campaign. The better you understand how an organization works on the inside, the more focused and effective your message will be.

Even minor variations in accountability between similarly named roles can entirely alter the way you articulate your value proposition. Those 10 additional minutes deciphering an org chart, double-checking against team activity, or identifying common KPIs can be the difference between being disregarded and being heard.

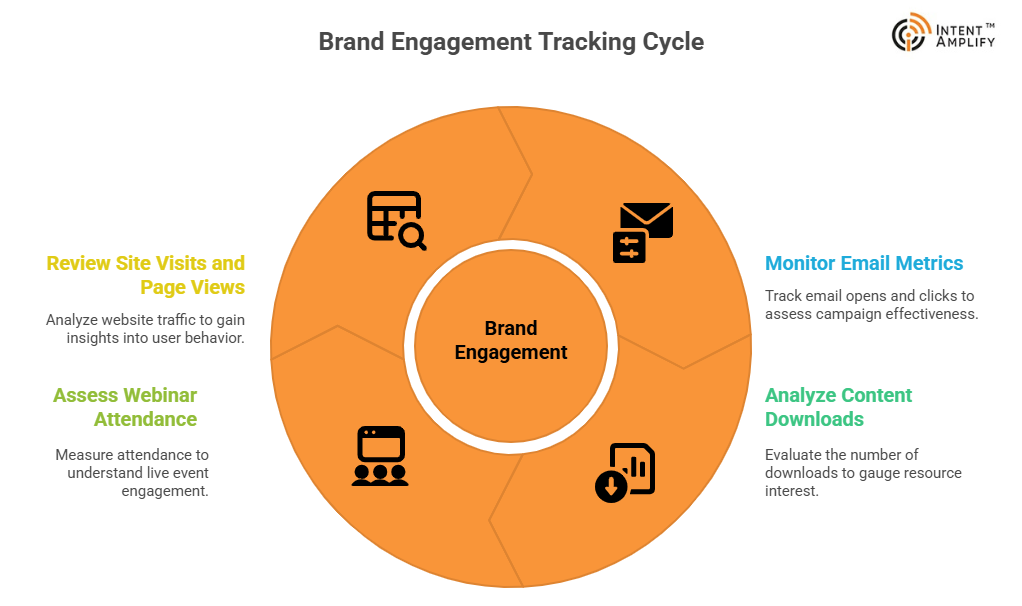

6. Tracking Engagement with Your Brand

Before you conduct cold outreach, determine whether a prospect is already familiar with you.

Marketing automation and CRM software such as HubSpot, Salesforce, and Outreach can prove:

- Email opens or clicks

- Content downloads

- Webinar attendance

- Site visits and page views

If someone visited your pricing page twice last week or downloaded your compliance white paper, that isn’t a cold lead. That is a warm signal you can use to create relevant, customized follow-up.

7. Buyer Persona Alignment

Successful research also involves knowing what most concerns various personas. A CFO will answer to cost effectiveness, whereas a Head of Marketing can be more interested in campaign performance or brand lift.

Utilize historical deal data, persona playbooks, and pain points by role to craft messaging that will connect. Explore recent posts, comments, or shares made by prospects to get a sense for your ideal communication style and areas of focus.

A report by Adobe reveals that 71% of buyers expect companies to understand their specific needs and provide personalized experiences across touchpoints. When SDRs tailor outreach based on role-specific priorities, response rates and conversion likelihood increase significantly.

8. Social Media Interaction & Behavioral Clues

Social media activity provides excellent real-time insight. Liking posts, sharing articles, or participating in industry discussion threads are great indicators of what’s at the top of mind.

LinkedIn and X (formerly Twitter) can provide behavioral cues such as:

- Interest in a topic or competitor

- Participation in an event or registration for a webinar

- Changes in tone or market view

For instance, if the VP of Marketing recently engaged three times on posts regarding personalization tools and their website has no sign of personalization, your outreach would close the gap. These signals tend to make the most out of subtle opportunities that generic outreach would not discover.

9. Use of Review Sites & Feedback Signals

Sites such as G2, Capterra, and TrustRadius are more than just software comparison sites; they’re treasure troves of actual customer insights. These sites are goldmines for determining what the persistent frustrations, unmet requirements, and expectations are that users have regarding a particular tool or category. With competitor review analysis, B2B teams are able to leverage real-world feedback to identify gaps in functionality, support, usability, or performance that prospects regularly grouse about.

This raw emotional data can be creatively flipped into value-oriented messaging. Instead of feature lists or catch-all promises, your outreach can respond directly to the prospect’s actual pain points:

“We learned that X tool does not have real-time analytics. This is how our platform gives you instant insights when you need them most.”

“Other companies we talked to listed onboarding delays as a big stumbling block. Our customers realize value 42% sooner because we’ve optimized the implementation process.”

Customizing your message in this manner shows sensitivity, understanding, and differentiation. It sends the message that you’re not merely listening, but also taking action on criticism others within the marketplace have dismissed.

10. Localized and Industry-Specific Personalization

No prospect wishes to be just another name on an email list. In the over-crowded inbox of today, copy-paste outreach is not difficult to identify, and not hard to ignore. What gets noticed is making communication feel personal, relevant, and location-aware.

Referencing local developments such as the launch of a new regional office, city-specific initiatives, participation in local industry events, or even regionally focused campaigns—shows that you’ve done your homework. It adds a layer of familiarity and specificity that signals genuine interest, not just automation.

To do this effectively, leverage geographic filters on your CRM, intent data platforms, or sales intelligence software. These filters allow you to target prospects in particular cities, states, or nations where pertinent news or updates are happening. For example, if a company has recently opened up in Austin, referring back to that expansion can indicate that you’re attuned to their growth narrative.

Coalition Technologies reports that highly personalized B2B emails including, those tailored by industry and specific buyer attributes, achieve 30% higher open rates and 50% higher click-through rates (CTR) compared to generic campaigns in 2025.

Final Thoughts

By 2025, the performance gap between top and average SDRs will be dictated by their level of research skills. Basic outreach will not have a chance in a world where customization is the minimum standard.

With the mastery of these 10 prospect research techniques, SDRs can trust their buyers faster, personalize value more accurately, and ultimately push potential opportunities.

Research isn’t only the starting point; it’s the differentiator. It equips SDRs with the power to initiate conversations with authority, customize messaging at scale, and discover opportunity before the competition even arrives. The more you understand about a buyer, the more likely they are to hear you out. And in an era of decreasing attention spans, that hearing ear matters.

FAQs

1. How can SDRs achieve research depth and outreach efficiency?

Begin by tiering your accounts. Invest more time in high-value targets, leveraging tools and templates to mass personalize. Even 10 additional minutes of research per key account can provide disproportionate payoffs.

2. How do review platforms like G2 assist in writing improved outreach messages?

By reading competitor reviews, SDRs can identify what users are frustrated with or lack in alternative tools. This allows you to position your solution as a superior alternative in the language of actual customers.

3. How can I confirm a prospect’s decision-making role beyond their job title?

Utilize LinkedIn to examine job titles, past positions, and company org charts. Knowing who decisions influence vs. who actually signs off on them means you reach the proper person with the proper message.

4. How do trigger events affect success with outbound sales?

Trigger events like funding rounds, leadership transitions, or product releases indicate organizational changes. Scheduling outreach during these events can increase relevance and result in many times higher engagement rates.

5. What’s the distinction between firmographic and technographic information in prospecting?

Firmographic information includes company-level characteristics such as industry, size, and location, and technographic information unveils the tools, platforms, and technology that a company is employing. Combined, they provide SDRs with greater insight for messaging that resonates.